These penyangak-penyangak left their marks ... we are left to clean up. - Tun Dr Mahathir Mohamad

Settlers were facing hardship, yet new cars were bought. - Datuk Seri Anwar Ibrahim

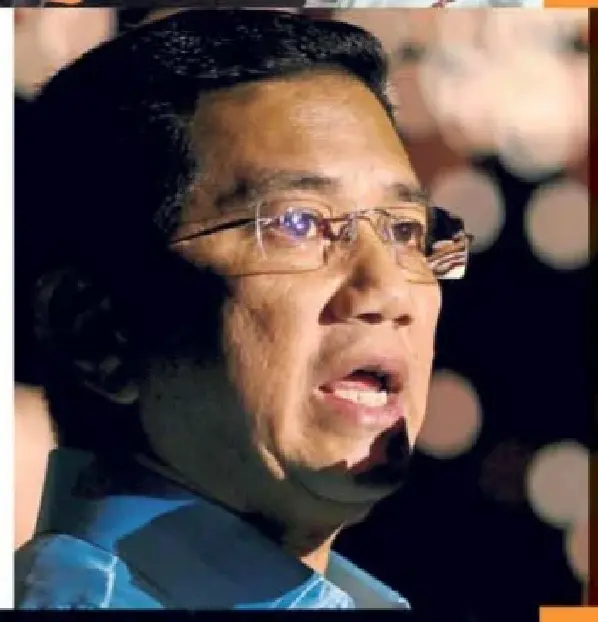

These actions were not only irresponsible but criminal in nature. - Datuk Seri Azmin Ali

Felda only incurred losses after Pakatan took over the government. - Datuk Seri Ahmad Maslan

The chairman held positions in as many as 39 Felda subsidiaries. Even

more shocking is that billions were used to ‘buy’ political support and a

stake in an Indonesian firm was acquired for 344% more than it actually

costs. And the agency’s debts rose by 1,100% in 10 years

‘Irresponsible and criminal’

KUALA LUMPUR: The Felda White Paper was tabled in Parliament, during which the government accused the previous administration of, among others, shady transactions and conflict of interest.

The Dewan Rakyat was told that some RM2.7bil of Federal Land Development Authority (Felda) money was used to buy political support before the last general election in May 2018.

Economic Affairs Minister Datuk Seri Azmin Ali, in tabling the White Paper on Felda in Parliament yesterday, said it was “corporate malfeasance” that led to Felda suffering massive losses.

He also alleged that former prime minister Datuk Seri Najib Razak was implicated in “shady deals”.

“(Najib), who was known as MO1 and who was the finance minister at the time, was involved in the investment process. These actions were not only irresponsible but criminal in nature,” he claimed.

Azmin cited the purchase of Indonesian company PT Eagle High Plantations Tbk from PT Rajawali Capital at a higher market rate as an example of the abuse of Felda funds.

He added that as of March this year, the RM2.3bil investment was only worth RM500mil.

On Tuesday, Felda director-general Datuk Dr Othman Omar lodged a police report claiming that Najib had pushed it into investing US$505mil (RM2.07bil) in Eagle High.

In the report, he said the amount paid to acquire a 37% stake in the Indonesian company was 344% more than its actual value of US$114mil (RM466.9mil).

Eagle High is part of the Rajawali Group owned by Peter Sondakh, who Othman claimed was close to Najib.

In black and white: Azmin with (from left) Felda chairman Tan Sri Megat Zaharuddin Megat Mohd Nor, his deputy Senator Dr Mohd Radzi Md Jidin and Othman showing the Felda White Paper at Parliament.

Azmin added that Felda’s debts had drastically risen by 1,100% from RM1.2bil in 2007 to RM14.4bil by 2017.

He also said there was a conflict of interest by former Felda chairman Tan Sri Mohd Isa Abdul Samad – referred to as FO1 – by holding positions in 39 other subsidiaries under Felda and Felda Global Ventures (FGV).

Isa, who was appointed as Felda chairman from January 2011 until January 2017, was FGV chairman as well as FIC chairman.

Later, wrapping up his reply to debate on the White Paper, Azmin said the government would adopt a new model in managing land under Felda which had been leased to FGV.

In his winding-up speech, Azmin acknowledged that it was difficult to return the land to settlers as Felda had leased it to FGV under a 99-year agreement.

“However, Felda is in the midst of reviewing the terms of the agreement with FGV so that it would benefit all parties, particularly settlers and Felda, although the land does not belong to them,” he said.

He added the White Paper on Felda would seek a new model to manage Felda land to ensure more profitable economic scale of return.

On claims by opposition lawmakers that Felda had made a loss after Pakatan took over, Azmin clarified that Felda’s true net value was only revealed after an impairment exercise was carried out on its assets.

He said the former Felda management had failed to carry out an impairment exercise to value its investment and kept quiet about it until 2018.

“They did not do the impairment exercise so the books would look good. If the management was honest, they would have carried out an impairment exercise between 2013 and 2016 to determine best value of the investment,” said Azmin.

He said when land was managed by Felda itself, it managed to obtain nett profit of RM1bil to RM2bil.

By Jagdev singh sidhu, martin carvalho, hemananthani sivanandam, rahimy rahim, and tarrence tan The Star

Planting seeds to a new Felda

New beginnings: The new Felda aims to be run as a well-functioning corporation with better internal controls.

THE scale of malfeasance was staggering. The White Paper on the goings-on in Felda and its subsidiaries read like a litany of wrongdoings that breached proper governance standards that most companies have to prescribe to.

There were many reasons why the checks and balances within Felda failed, largely because there was none. The concentration of authority within the hands of a few individuals, with little exercise of fiduciary duty by other members of the board, meant a free hand for the few.

The forensic audit conducted by Ernst & Young detailed the collapse of internal controls and oversight in a number of deals done by Felda. Overpriced deals were made and in the end, it was the settlers that bore the brunt of the consequences.

Charges have been filed against former Felda chairman Tan Sri Mohd Isa Abdul Samad, and given the scale of alleged fraud that had taken place, more police reports are about to be lodged in the days and weeks ahead. And more people are expected to face charges.

All of that will mean that justice to what had happened at Felda will be sought. That process will take time, but in the meantime, the main thrust of the White Paper, apart from detailing the cocktail of crimes, was what to do with Felda next.

The key take-away from the report was that there will be a new Felda. The old one, with its own legacy problems, meant that it will be best to start over again with a new focus.

The financial performance of Felda warrants the change as it has been losing money since its unit FGV Holdings Bhd was floated on Bursa Malaysia and its debt ballooned from RM1.2bil in 2007 to RM14.4bil in 2017. And its assets just about doubled. From those numbers alone, it was imperative that financial assistance from the government be extended to rehabilitate Felda.

The government will inject RM6.23bil into Felda in stages in the form of grants, loans and guarantees and much of that money will actually go towards reworking Felda.

The agency’s debt will be taken care of and so will the settlers’ loans. Housing for second-generation Felda settlers will be built and RM480mil will be given to help pay for their living cost.

In changing Felda from what it is now to what it should morph into, the government will inject RM1bil for the settlers to plant new cash crops.

Relying on palm oil and rubber alone has been good, and the settlers and Felda benefited from that. But in today’s world, other cash crops have gained prominence over the golden crop of Malaysia.

With the price of food, which includes fruits and vegetables, along with livestock, having increasing value, the shift towards these crops is understandable and inevitable.

Settlers will be able to get more income from cultivating such crops and rearing livestock to go along with the lease agreement they can get by agreeing to allot their rights to their oil palm estates to Felda for a steady monthly return.

Felda can then use the economies of scale from the amalgamated lands and better productivity to generate higher returns. The use of modern technology in farming Felda land is also in the right direction.

The other steps put forward by Economic Affairs Minister Datuk Seri Mohamed Azmin Ali is to have better infrastructure in the areas within the scheme, improve development of human capital and a host of other measures that seek to revitalise the prospects of the settlers and their next generation.

The new Felda aims to be run as a well-functioning corporation. Governance, transparency and all the other buzzwords that mean better internal controls and eliminating corruption needed to be done.

Having professionals run Felda is the correct move and with all of this, it is hoped that Felda will shed its sordid past and return the agency to what the settlers and their kin have sacrificed for.

The overarching intention of the revamped Felda is to make sure that only the welfare of the settlers and the agency are taken care of.

It is also a political move to ensure that a key vote bank that helped swing the tide of the last general election remains intact. But beyond the politics, the revamp of Felda is a much-needed move that will only serve to benefit those involved in the scheme and the country.

It is the right thing to do.THE scale of malfeasance was staggering. The White Paper on the goings-on in Felda and its subsidiaries read like a litany of wrongdoings that breached proper governance standards that most companies have to prescribe to.

There were many reasons why the checks and balances within Felda failed, largely because there was none. The concentration of authority within the hands of a few individuals, with little exercise of fiduciary duty by other members of the board, meant a free hand for the few.

The forensic audit conducted by Ernst & Young detailed the collapse of internal controls and oversight in a number of deals done by Felda. Overpriced deals were made and in the end, it was the settlers that bore the brunt of the consequences.

Charges have been filed against former Felda chairman Tan Sri Mohd Isa Abdul Samad, and given the scale of alleged fraud that had taken place, more police reports are about to be lodged in the days and weeks ahead. And more people are expected to face charges.

All of that will mean that justice to what had happened at Felda will be sought. That process will take time, but in the meantime, the main thrust of the White Paper, apart from detailing the cocktail of crimes, was what to do with Felda next.

The key take-away from the report was that there will be a new Felda. The old one, with its own legacy problems, meant that it will be best to start over again with a new focus. The financial performance of Felda warrants the change as it has been losing money since its unit FGV Holdings Bhd was floated on Bursa Malaysia and its debt ballooned from RM1.2bil in 2007 to RM14.4bil in 2017. And its assets just about doubled. From those numbers alone, it was imperative that financial assistance from the government be extended to rehabilitate Felda.

The government will inject RM6.23bil into Felda in stages in the form of grants, loans and guarantees and much of that money will actually go towards reworking Felda.

The agency’s debt will be taken care of and so will the settlers’ loans. Housing for second-generation Felda settlers will be built and RM480mil will be given to help pay for their living cost.

In changing Felda from what it is now to what it should morph into, the government will inject RM1bil for the settlers to plant new cash crops.

Relying on palm oil and rubber alone has been good and the settlers and Felda benefited from that. But in today’s world, other cash crops have gained prominence than the golden crop of Malaysia.

With the price of food, which includes fruits and vegetables, along with livestock, having increasing value, the shift towards these crops is understandable and inevitable.

Settlers will be able to get more income from cultivating such crops and rearing livestock to go along with the lease agreement they can get by agreeing to allot their rights to their oil palm estates to Felda for a steady monthly return. Felda can then use the economies of scale from the amalgamated lands and better productivity to generate higher returns. The use of modern technology in farming Felda’s land is also in the right direction.

The other steps put forward by Economic Affairs Minister Datuk Seri Mohamed Azmin Ali is to have better infrastructure in the areas within the scheme, improve development of human capital and a host of other measures that seek to revitalise the prospects of the settlers and their next generation.

The new Felda aims to be run as a well-functioning corporation. Governance, transparency and all the other buzzwords that mean better internal controls and eliminating corruption needed to be done. Having professionals run Felda is the correct move and with all of this, it is hoped that Felda will shed its sordid past and return the agency to what the settlers and their kin have sacrificed for.

The overarching intention of the revamped Felda is to make sure that only the welfare of the settlers and the agency are taken care of. It is also a political move to ensure that a key vote bank that helped swing the tide of the last general election remains intact. But beyond the politics, the revamp of Felda is a much-needed move that will only serve to benefit those involved in the scheme and the country.

It is the right thing to do.

By jagdev singh sidhu The Star

Related posts: