The 5.35% dividend announced last year would have ranked the EPF 22nd in terms of return. — Bloomberg

Rate of return from the retirement fund well above domestic headline inflation rate

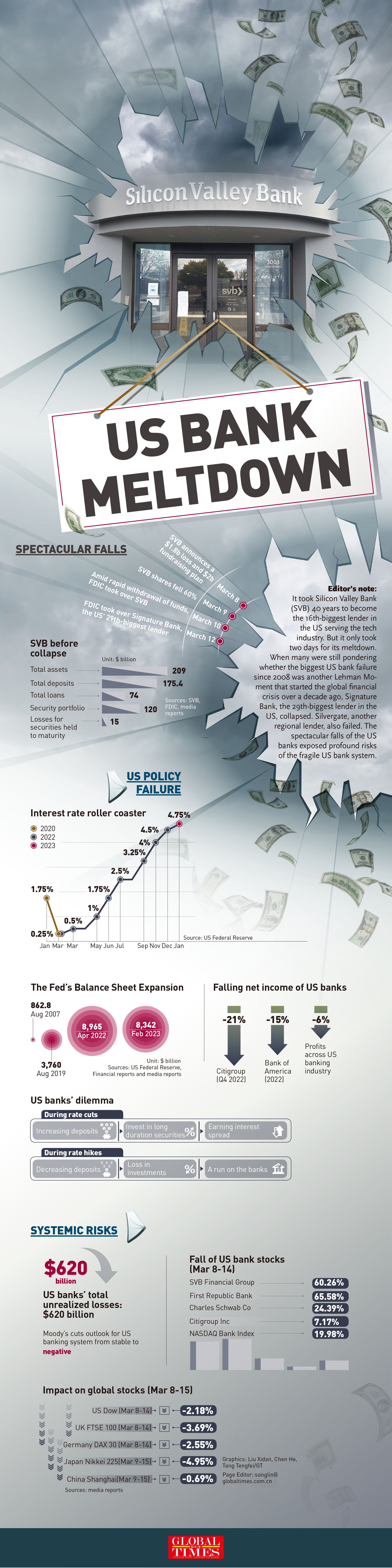

RECENTLY, the Employees Provident Fund (EPF), the nation’s largest pension fund, declared a dividend rate of 5.35% for conventional savings for 2022. This was a lower sum compared with 2021’s 6.1%. Over the course of a decade, EPF dividends for conventional savings had ranged from a low of 5.2% in 2020, to a high of 6.9% in 2017. The perennial question has been just how does the dividend by the EPF compare with individual asset class funds like unit trust which allows investors to gain bigger exposure in their investments by diversifying their asset holdings. Whitman Independent Advisors founder and managing director Yap Ming Hui says while some unit trusts can provide investors with a higher return than EPF ranging from 15% to 20%, the fund volatility is also high where unit trusts’ returns can fall as much as 30% to 40% in a short time. “There are many types of unit trusts, namely the equity unit trust, fixed income unit trust, and money market unit trust. If you have a long term view on the investment, say 10 to 15 years, then equity unit trust would have better returns than the EPF. “Generally, the returns for equity investments are higher than fixed income assets like bonds. Hence, the rate of return and risk levels are dependent on the type of unit trusts that you buy into,” he told For 2022, EPF’S total gross investment income came in nearly 20% lower year-on-year (y-o-y) at Rm55.3bil compared with Rm68.9bil in 2021 due to the vagaries of the capital markets at home and abroad. Foreign investment contributed 45% of the EPF’S total gross investment income and made up about 36% of the EPF’S investment assets. In terms of asset allocation, 47% of EPF’S investment assets were in fixed income instruments in 2022, while equities made up 42%. Real estate and infrastructure as well as money market instruments took up a 7% and 4% stake in EPF assets, respectively. Last year, Rm30.5bil, or 55% of the EPF’S total gross income derived from the equities asset class. This was a 26% y-o-y decline from the Rm41.1bil recorded in 2021. Foreign listed equities were the main driver for this asset class, registering a return on investment (ROI) of 9.3%. The premier retirement savings fund has nearly half of its total asset allocation in fixed income instruments which includes Malaysian Government Securities (MGS) and equivalents along with loans and bonds. This portfolio contributed an Note: List of unit trusts launched prior to 2018 Returns in the calendar year 2022. Source: Novagni Analytics graphics income of Rm18.2bil, or 33% of the EPF’S total gross income. Moreover, the real estate and infrastructure portfolio recorded an income of Rm5.6bil with an ROI of 10.5%, whereas gains from money market instruments stood at Rm1bil with an ROI of 3.5% in 2022. The EPF dividend when compared with the list of 681 unit trusts generally has performed well. With the exception of 2019 and 2020, the dividend paid by the EPF in 2018 and 2021 puts the retirement fund dividend in the top 25% of the unit trust industry. The 5.35% dividend announced last year would have ranked the EPF 22nd in terms of return. The same could be said when EPF returns are pitted against the other 108 mixed assets (balanced funds) in the country.The year 2018 was EPF’S best performing year as its returns were the highest when compared with balanced funds. Apart from 2019 and 2020, the dividends issued by EPF were in the top 20% of the balanced fund market. Last year, EPF ranked eighth for its return rate.

- The Star Malaysia18 Mar 2023By elim POON elimpoon@thestar.com.my

EPF a more stable investment option than unit trusts

Financial Planning Association of Malaysia chief executive officer Linnet Lee states the EPF is a more stable investment option than unit trusts as it has a track record for its return rate. “As soon as a person takes his or her money out of the EPF or their bank account, this person must understand that there are risks already, namely market risks, interest rates fluctuation, and currency exchange risks for funds that have overseas investments. “The EPF has lower risk levels as it is obligated to provide a minimum dividend rate of 2.5%, as outlined in the EPF Act 1991, even if market conditions do not look good. For the last 10 years, the EPF’S dividend rate has always been above this level,” she says. Despite the bearish and volatile markets last year that led to EPF’S lower gross investment income performance, the EPF’S return rate in 2022 outmatched many unit trusts and financial market’s performance. Morgan Stanley Capital International (MSCI) World Index for instance, recorded a 17.7% decline in its 2022 performance while the MSCI Emerging Markets Index fell by 19.74% last year. On the other hand the FBM KLCI shed 72 points or 4.6% y-o-y in 2022, with a high of 1,618.5 and a low of 1,373.4 for the year. The rate of return from the retirement fund was also well above the domestic headline inflation rate averaging at 3.3% last year as well as the return on the 10-year MGS which yielded 4.07% at the end of 2022. However, some may argue that unit trusts offer greater flexibility in terms of investment and contributions, as investors are exposed to different investment themes matched with their risk appetite. The common investment products offered by unit trusts are money market, fixed incomes, property, and equities. On this note, Tradeview Capital Sdn Bhd portfolio manager Ng Tzyy Loon says while this may be the case, many individuals do not have time to do the necessary research before buying an investment like unit trust. “For these investors, the EPF is a very convenient tool which often becomes their default choice. It is actually not an easy feat for EPF to be able to deliver a consistent return of 5% to 6% over the years, given that the fund size the organisation is managing is about RM1 trillion,” he says. In choosing the right unit trust, Ng opines that investors should opt for one that has a more flexible mandate and outperforms its investment benchmarks. “Investors need to have the mindset that they are taking risks to get a better return when they opt for unit trusts instead of the EPF. A unit trust with a flexible mandate means that the fund manager has more room to make investment decisions in different market conditions. “For example, fund managers can avoid gold mining companies in an equity unit trust, unlike in a commodity unit trust, should prices of precious metals fluctuate in a particular year. “Additionally, a unit trust that has consistently outperformed its investment benchmark is reflective of the skillfulness of the fund manager in managing the fund,” he says. Nevertheless, as Yap pointed out, investors need to take into account the various fees and expenses, which can potentially reduce returns, accompanying a unit trust fund. There are altogether three main fees when buying a unit trust; sales charge, fund management fee, and trustee fee. “Sales charge are front end fees that can go as high as 5.5%. There is also the fund management fee of about 1% to 2%. Lastly, investors are also charged with a trustee fee of less than 1%,” he says. While it seems that there are no outright fee charges for EPF members, the returns received by account holders is net expenses. “All the expenses incurred from hiring analysts, fund managers, and compliance-related are reflected in the income statement. These fees can be lower that that of unit trusts” says Ng. All in all, having a well-diversified portfolio is the key to protect one’s wealth, notes Lee.“If you are looking to build a retirement nest egg, you need to diversify your money into different asset classes. Hence, it would be good to make contributions in the EPF and at the same time invest in unit trust funds,” she says.

- The Star Malaysia18 Mar 2023

Related posts:

A good payday for EPF contributors, as EPF declares 5.35% dividends for 2022

EPF declares 5.35% dividend for conventional savings, 4.75% for syariah

EPF DELIVERS COMPETITIVE RETURNS AMID ... - KWSP

EPF dividend for the year 2022 has been announced! Here are..

Here are the top 5 things you can do with it

EPF withdrawals larger than GDP of some countries, says fund's..

Top Performing Unit Trust Funds in Malaysia 2023! - Loanstreet

Best Unit Trust Investment Plans in Malaysia - Compare & Apply

Understanding Unit Trust Schemes - FIMM

Understanding unit trusts - MoneySense

Understanding Unit Trust Schemes - FIMM

Understanding unit trusts - MoneySense

Top Performing Funds - Public Mutual Berhad

Top Performing Funds - Public Mutual Berhad

| Fund Name | Shariah Based | Nature of Funds | 10-Year Return (%) | 10-Year Annualised Return (%) | Fund Volatility Class (FVC) | 3-Year Fund Volatility Factor (FVF)# |

|---|---|---|---|---|---|---|

| PUBLIC GLOBAL SELECT FUND | - | Foreign | 151.35 | 9.65 | HIGH | 16.1 |

| PUBLIC ISLAMIC OPPORTUNITIES FUND | Domestic | 127.87 | 8.58 | VERY HIGH | 28.1 | |

| PB CHINA PACIFIC EQUITY FUND | - | Foreign | 105.03 | 7.44 | HIGH | 19.0 |

| PUBLIC CHINA SELECT FUND | - | Foreign | 101.27 | 7.24 | VERY HIGH | 19.6 |

| PUBLIC SMALLCAP FUND | - | Domestic | 98.68 | 7.10 | HIGH | 15.9 |

| PUBLIC FAR-EAST ALPHA-30 FUND | - | Foreign | 94.84 | 6.89 | HIGH | 16.3 |

# Based on the fund's portfolio return as at 31 Jan 2023 (Source: Lipper)