Power shift: Asean has a big opportunity this week to help usher in the new world order. — Bernama

ON April 2, US President Donald Trump smashed the World Trade Organisation’s system of multilateral trade by announcing the imposition of tariffs, starting at midnight on April 9, on imports from “cheater” countries that were engaging in unfair trade practice. To Trump, a cheater is one that exports more goods to the United States than it imports.

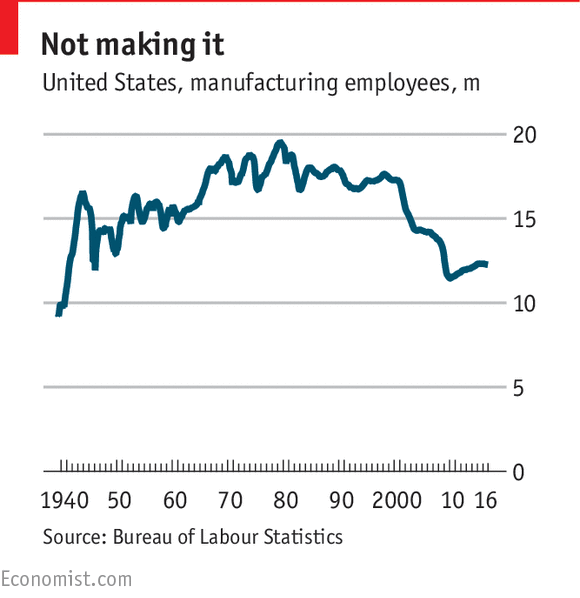

This is nonsensical reasoning. A bilateral trade deficit is not evidence of being “cheated” because the payment to my barber does not mean that I have been cheated and my salary does not imply that my employer has been bamboozled. This nonsense shows that the tariff war is only marginally related to unfair trade practices. The two key reasons for the tariffs are to increase wages by bringing manufacturing jobs back to America and to cement US primacy in the global order with a show of force.

Tragically, the tariffs will neither revive manufacturing nor preserve US primacy. Tariffs will temporarily expand employment in a few sunset industries, but wages will remain stagnant because productivity growth potential in those sectors is nonexistent.

The immediate response to Trump’s show of force were precipitous collapses in the prices of US stocks and bonds, and the value of the US dollar. Investors recognised that this Great Wall of Tariffs had isolated the US economy, inevitably impoverishing it. Hence, 13 hours after the tariffs came into force, Trump suspended them for every trading partner except China. This climbdown made clear that the real target is China, which the US perceives to be an unfriendly power (eg, being friendly to Iran) that is engaging in unfair trading practices (eg piracy of US technologies).

The economist Adam Smith had anticipated this kind of clash in 1776. He observed that the three centuries of globalisation that began with the discovery of the Americas in 1492 and the discovery of the sea route from Europe to India in 1498 had overwhelmingly benefited Europe because its much greater military might enabled it to pillage instead of trade.

Smith, however, foresaw a reversal: the diffusion of technology through trade would eventually narrow the gap between the two groups. The economic rise of Japan, South Korea, China, and India is ushering in today’s messy transition from a unipolar to a multipolar order.

Asean should be guided by two understandings in navigating this transition.

The first is that the current US-China confrontation stems from their shared recognition that the prevention of war would require an eventual agreement on their respective spheres of influence. We are witnessing a defensive race between them to expand their spheres of influence, which is why the US has asserted its rights over Canada, Greenland, Panama, and Gaza; and China’s nine-dash line in the South China Sea has brought its maritime border to the doorstep of several Asean nations.

States that lock themselves into Washington’s orbit will be under strong pressure to decouple from Chinese technology and to shrink commercial ties with the world’s largest trader – sacrificing not only today’s access to the Chinese market (prospectively, tomorrow’s access to India) and compromising their sovereignty.

The second understanding is that this transition has created systemic dangers that require institutional responses. These new dangers include the Thucydides Trap which is the risk of war between rising and established powers; the Kindleberger Trap where inadequate international cooperation leads to ineffective handling of global disasters like climate change; and the Tragedy of the Commons which identifies the coming collapse of the food chain.

The Cold War 2.0 is causing growing collateral damage to Asean. A viable alternative to membership by Asean states in one of the spheres of influence is for Asean to cooperate with other middle power countries to form a nonpartisan club that functions as a buffer zone between the spheres of influence.

It is crucial for this club to achieve critical mass quickly – being big enough in population and GDP to earn begrudging acceptance by Washington, Beijing, and Moscow for its right to remain a neutral force. To achieve critical mass quickly, the founding group of countries must be kept to a manageable number to ease negotiations.

Asean must avoid instinctively shaping a Global South response like convening a new Bandung Conference (which brought together 29 newly independent Asian and African countries in 1955). The goal is not to accentuate class warfare at the international level but to maintain economic globalisation, world peace, and environmental sustainability.

To achieve critical mass quickly, this club must also bridge the Global South and the Global North. After establishing deep cooperation among Asean, Japan and South Korea (thereby setting the tone of North-South cooperation), this Asian grouping should propose to the European Union and United Kingdom the formation of the Atlantic-Pacific Sustainability Partnership (APSP).

The APSP would serve three core functions: (a) defend economic globalisation with a free trade area based on open regionalism; (b) defend global peace and environmental sustainability with a sustainability caucus to reduce tensions among major powers and coordinate actions on common challenges like pandemics; and (c) defend mutual aid with a development assistance agency guided by the 17 United Nation’s Sustainable Development Goals (SDGs) to counterbalance the use of development aid by major powers as a means of political influence.

Given the accelerated growth of Asean under this new system, the economic weight of the APSP would be more than twice that of China or the US by 2045, making it necessary for US and China to join the APSP to avoid defeat through self-marginalisation.

When this happens, the APSP would have crowded out Cold War 2.0 with cooperative multilateralism.- by Prof Datuk Dr Woo Wing Thye

Renowned economist Prof Datuk Dr Woo Wing Thye is a visiting professor at Universiti Malaya and research professor at Sunway University. He is also Professor Emeritus of Economics at the University of California, Davis; University Chair Professor at Liaoning University; and Distinguished Fellow at the Penang Institute.

The views expressed here are solely the writer’s own.

Related:

ASEAN-China-GCC cooperation to inject certainty into global economy

Cooperation between the Association of Southeast Asian Nations (ASEAN), China and the Gulf Cooperation Council (GCC) countries will unlock immense ..

Related posts:

https://youtu.be/OCk4VkAKKFc

https://youtu.be/OCk4VkAKKFc